The Non-Fungible Trend

- Kaiden Lawrence

- Jul 17, 2021

- 3 min read

Updated: Jul 28, 2021

Crypto momentum has been slowly depressing. Portfolios are down, and as traders we begin to search for beacons of comfort and safety. Wishing that we could just curl up in a blanket, sleep for a night's sleep, and wake up to Bitcoin hitting a high of $150,000.

While the bubbles have clearly burst, we may need to come to terms with the cold fact that $150K isn't happening anytime soon. We may need to develop some Wim Hof breathing techniques to weather what some are calling the "crypto winter."

As the buying trendzy has slowed, and $1 trillion has vanished from the crypto market cap, we find ourselves asking many questions:

What financial trends should I consider now?

How can I protect the things I own?

How do I claim rights to my creations?

How can I acquire things that have value?

Many companies such as Budweiser and AB InBev are teaming up with NFT production companies. Vayner NFT is a very new company that is getting together with these companies. Their job is to consult, strategize, and then launch NFT projects that are used not only for marketing, but providing a sense of exquisite uniqueness to the consumer. Spending time marketing with NFT's is so different from commercials or brand campaigns in that there is no hiding behind big headlines or reports. It will be extremely easy to see the economics of the specific NFT, which will help to keep companies accountable. It's actual self or business branding that is better than any amount of yelp reviews or Instagram followers to influence and dictate the level of respect your company receives.

Protecting intellectual property, proprietary information, web domains, collectibles like sports memorabilia, and most popularly so-called "art" is of the latest trends. Let's consider art for a minute. Art consists of many things such as style, music, paintings, drawings, photos, quotes, videos...any spectacle. Searching paintings by Salvador Dali, seeing his exquisite pieces, ordering one online, getting it framed, and hanging it in our home sounds like a great change of scenery. What if you could verify that you had bought an original piece or print? The real hand painted thing? The authenticated and appraised ownership would enable you to make the purchase with trust and confidence. It would enable you to discuss the piece amongst friends with clear conviction of authenticity & ownership. How is that different from buying the art from an expensive New York City gallery?

NFT's (Non-Fungible Tokens) are your digital way to invest in "art". It allows artists to create social prestige as they showcase their original assets on the internet. The number of artists gaining exposure and the variety of styles of digital art are making it nearly impossible for crypto enthusiasts to avoid losing hours browsing online galleries like on raribles.com and opensea.io With more than $2 million spent on NFT's in the first quarter of this year, this explosion of the market is happening whether you understand it or not. Minting tokenized assets can be done quickly using protocols like Raribles.com. The Silicon Valley based NFT exchange, and others like OpenSea.io , are helping as vehicles for artists to transport their work around the globe. It's Art in the name of cryptocurrency!

NFT protocols and the top collections can be found at NFT Protocols Listed By Market Capitalization | CoinMarketCap

The variety of designs you find may be baffling. What is "valuable" to one person is subjective. Check out some of the NFT collections NFT Collections Listed By 7 Day Sales Volume | CoinMarketCap

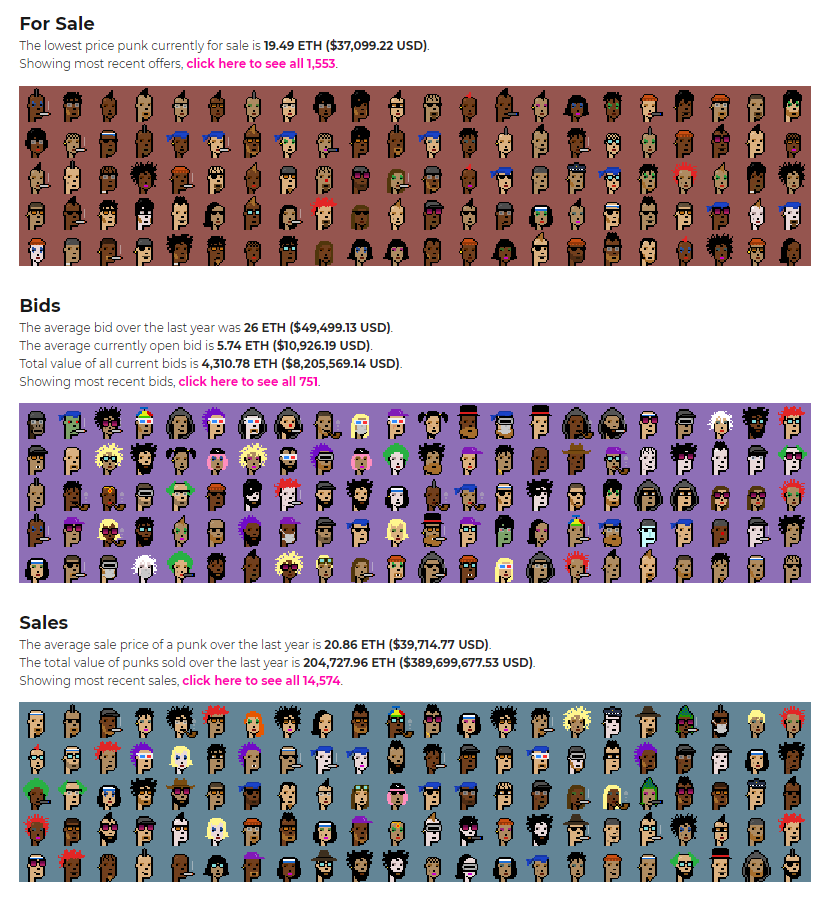

The #1 revenue grossing collection is called CryptoPunks. An average CryptoPunk sells for around 21 ETH or $39,000 USD. Actually, you need to look for yourself. We can finish this conversation after you get crypto-punked:

So, yes. You did read that $389,699,677.53 USD of punks were sold last year. Of course, anti-money laundering red flags get waved when this kind of money movement takes place so swiftly and on such a grand scale. Rest assured that the same regulations that officials are seeking to put on other cryptos will be applied in this area of "investing." NFT's, even when regulated, will aim to tokenize and create an ecosystem of evidence. Proof-of-ownership, proof-of-purchase, royalties, and rights encrypted into blockchain and the Internet of Things.

How long until we are identified by our personal NFT IDs....Like Big Chungus??

FNL content including, but not limited to, articles, podcasts, videos, live streams, and websites are intended for informational purposes and should NOT be considered financial, investment, nor trading advice. Cryptocurrency, futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. https://futuresnetworks.live/risk_disclaimer

Comments